Editorial

Scientific Realities Should Moderate Official Statements on Avian and Bovine Influenza

|

|

To date, APHIS has been factual in their minimal reporting on the ascending incidence of bovine influenza-H5N1. In contrast, a number of State Veterinarians have been far more optimistic in their official statements dampening concern over the potential of the virus to become zoonotic. To date, APHIS has been factual in their minimal reporting on the ascending incidence of bovine influenza-H5N1. In contrast, a number of State Veterinarians have been far more optimistic in their official statements dampening concern over the potential of the virus to become zoonotic.

The major concern is the possible emergence of a zoonotic strain of H5N1 as noted by the World Health Organization that regards the virus as a potentially pandemic strain requiring surveillance over a range of avian and mammalian species. At this time, there is no evidence that spontaneously altered strains of H5N1 are infectious to humans although affecting a wide range of terrestrial and marine species with evident animal-to-animal spread. Despite the recovery of H5N1 virus from a dairy-herd employee with conjunctivitis, the only previous U.S. case occurred in a worker involved in depopulation of an infected flock. Given thousands of worker hours of exposure in 2015 and then again during the 2022-2023 epornitics, one asymptomatic case suggests that even with extreme exposure, humans are currently refractory to infection. The major concern is the possible emergence of a zoonotic strain of H5N1 as noted by the World Health Organization that regards the virus as a potentially pandemic strain requiring surveillance over a range of avian and mammalian species. At this time, there is no evidence that spontaneously altered strains of H5N1 are infectious to humans although affecting a wide range of terrestrial and marine species with evident animal-to-animal spread. Despite the recovery of H5N1 virus from a dairy-herd employee with conjunctivitis, the only previous U.S. case occurred in a worker involved in depopulation of an infected flock. Given thousands of worker hours of exposure in 2015 and then again during the 2022-2023 epornitics, one asymptomatic case suggests that even with extreme exposure, humans are currently refractory to infection.

Although there have been over 800 documented cases of H5N1 or H7N9 influenza among humans in Asia over two decades, the attack rate is exceptionally low given the level of potential exposure since emergence of these strains in poultry. Most of the cases involved either the elderly or the immunosuppressed. Patients in most instances presented with a history of contact with live poultry either on farms or in wet markets as with the two cases documented in South America in 2023.

Given the reality that migratory marine birds and waterfowl are susceptible to H5N1 and disseminate the virus across five continents, ultimately, mutations may occur that may result in a zoonotic strain. The higher the concentration of susceptible birds or livestock in an area or on a farm, the greater will be the probability of either a mutation or a recombinant event.

Accordingly, it would be advisable to consider human health as a justification to create non-susceptible commercial bird populations through immunization. Currently, archaic and inappropriate trade restrictions in addition to the imposition of contrived trade barriers disfavor universal adoption of vaccination. The World Organization of Animal Health supports the principle of vaccination and clearly states that this modality should not be a restraint to trade providing there is adequate surveillance to detect infection in immunized flocks. In the age of PCR, this is an achievable objective. It will be possible for regulator y authorities to introduce and manage a program of certification to confirm that export consignments are derived from flocks free of infection. y authorities to introduce and manage a program of certification to confirm that export consignments are derived from flocks free of infection.

The concerns of the broiler segment of the U.S. poultry industry concerning vaccination are recognized. When human health is considered, the potential of losing export sales pales in significance to even the slightest risk of an emerging pandemic. The cost of COVID with the attendant loss of more than one million of our fellow citizens suggests that H5N1 avian influenza is more than just a “chicken and turkey problem”.

It is now time to implement regional vaccination against HPAI in areas with a history of infection and specifically for turkey and egg-production flocks. The associations representing the segments of the U.S. poultry industry, APHIS, USAPEEC and the Office of the U.S. Trade Representative need to coordinate and intensify their activities to accept rigorously controlled vaccination. As far as possible, issues relating to restraint in trade based on vaccination should be resolved given that HPAI is now panornitic in distribution.

A statement by a mid-west State Veterinarians that “research to date has shown that mammals appear to be dead-end hosts which means that they are unlikely to spread HPAI further” is simplistic and is devoid of substantiation by either current virology or epidemiology. State Veterinarians are tasked with preserving the health of flocks and herds under their jurisdiction and should not be cheer-leaders for consumption of livestock products. With respect to HPAI, there is more at risk than either loss of trade or the cost of depopulation. Creating a solidly immune population of commercial poultry would contribute to a lower risk of facilitating a zoonotic strain of avian influenza. The emergence of bovine influenza-H5N1 in March and outbreaks in mink and marine mammals should be a warning of the potential for an influenza pandemic reminiscent of the 1918-1919 catastrophe. Risks of mutation might be small but economic and humanitarian consequences are infinite.

|

Egg Industry News

Egg Week

|

|

USDA Weekly Egg Price and Inventory Report, April 10th 2024.

Market Overview

- The average wholesale unit revenue values for Midwest Extra-large, Large and Medium sizes were unchanged this past week. Wholesale prices for Midwest in cartons were approximately 20 cents per dozen above the 3-year average of $2.40 per dozen for the corresponding week in 2023. This past week shell egg inventory was up by a noteworthy 10.3 percent, following a fall of 0.1 percent the previous week. Although there has been a weekly increase in pullet flocks transferred to laying houses, hen numbers are constrained by the loss of close to 13 million hens due to HPAI on twelve complexes holding from 250,000 to 2.6 million hens during the 4th Quarter of 2023. Pullets are in short supply with losses of 2.5 million growing birds mainly in California.

- This past week chains apparently narrowed the spread between delivered cost and shelf price. This could result in a potential reduction in generic stock with a proportional rise in demand but only with constant re-ordering to fill the pipeline through April. Discounters are holding prices on generics influencing mainstream retail stores. Eggs are still highly competitive in price against the comparable costs for other protein foods.

- Total industry inventory was up by 8.1 percent overall this past week to 1.63 million cases with a concurrent 0.8 percent decrease in breaking stock, following a 3.7 percent fall during the preceding processing week. Demand for egg products resume after the Easter weekend with more home baking and entertaining. Egg products are required for the food service and manufacturing sectors and exports increased in February. USDA Benchmark wholesale price for eggs in cartons was approximately $0.70 per dozen lower than the corresponding week in 2023.

- It is now apparent that the inventory held by chains and other significant distributors may be more important over the short term in establishing wholesale price compared to the USDA regional inventory figures. Changes in stock held by DCs and in the pipeline as determined by weekly orders are probably responsible for small cyclic fluctuation in weekly industry stock, especially into and after a holiday weekend.

- Cases of HPAI in the commercial poultry industry and backyard (non-commercial WOAH) flocks tapered during the first quarter of 2024, coincident with the end of the Fall migration of waterfowl that was extended in late 2023 by mild weather. The emergence of the infection in a large complex holding 1.6 million hens and 340,000 pullets in western Texas suggests a reoccurrence as northward spring migration commences. The second case in Michigan involving a 2-million hen complex may have been an indirect extension from an infected dairy herd although an epidemiologic evaluation is in progress. The number and extent of future possible outbreaks during the spring and fall months of 2024 cannot be projected but sporadic cases in backyard poultry and dairy herds in six widely diverse states is a cause for concern. More surveillance information should be released by USDA-APHIS as it becomes available concerning the prevalence rate of carriers among resident domestic free-living birds and a review of molecular and field epidemiology for the 2022 spring and fall waves of HPAI. The USDA has yet to identify specific modes of transmission for the 2022-2023 epornitic including likely airborne spread from wild birds and their excreta over short distances.

- The current relationship between producers and chain buyers based on a single commercial price discovery system constitutes an impediment to a free market. The benchmark price appears to amplify both downward and upward swings as evidenced over the past two years. A CME quotation based on Midwest Large, reflecting demand relative to supply would be more equitable. If feed cost is determined by CME ingredient prices then generic shell eggs should be subject to a Midwest Large quotation.

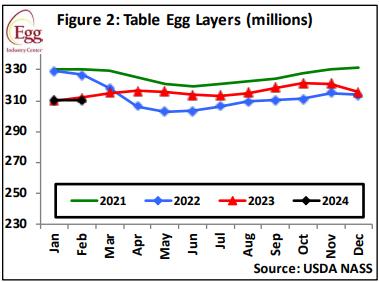

- According to the USDA the U.S. flock in production was apparently down by 0.1 million hens (<0.1 percent) to a new level of 306.3 million for the week ending April 10th The stated total flock of 311.9 million included about one million molted hens that will resume lay during coming weeks plus 4.5 million pullets scheduled to attain production. Given the latest figures it is estimated that the producing flock is at least 17 to 19 million hens lower than before the onset of HPAI in 2022. In January 2024 the USDA adjusted figures to account for depopulation of 13 million hens spread over the last quarter of 2023. There were evident discrepancies between published figures and the theoretical number of hens taking into account known losses and predetermined pullet replacements. The early April loss of 3.5 million hens is not reflected in data released over the past two weeks. It is hoped that the USDA Agency responsible for publication of flock size will coordinate with APHIS to record the number of depleted flocks and promptly provide accurate data.

- The ex-farm price for breaking stock (rounded to one cent) was down 1.6 percent to $1.58 per dozen.Checks delivered to Midwest plants were unchanged at $1.42 per dozen this past week. Prices for breaking stock should follow the wholesale price for shell eggs usually with a lag of about one to two weeks.

The Week in Review

Prices

According to the USDA Egg Market News Reports released on April 8th 2024, the Midwest wholesale price (rounded to one cent) for Extra-large was unchanged from last week to $2.43 per dozen. Large was unchanged at $2.41 cents per dozen. Mediums were unchanged at $2.30 per dozen delivered to DCs. Prices should be compared to the USDA benchmark average 4-Region blended nest-run cost of 75.3 cents per dozen as determined by the Egg Industry Center based on USDA data for March 2024. This value excludes provisions for packing, packaging materials and transport, amounting to 57 cents per dozen as determined in mid-2023 from an EIC survey (with low response) and now realistically 60 cents per dozen.

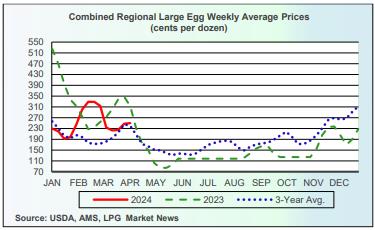

Currently producers of generic shell eggs should be operating with positive margins irrespective of region and customer-supply agreements. The progression of prices during 2023 and 2024 to date is depicted in the USDA chart reflecting three years of data, updated weekly.

The April 8th edition of the USDA Egg Market News Report confirmed that the USDA Combined Region value (rounded to the nearest cent), was up 2 cents per dozen to $2.50 per dozen delivered to warehouses for the week ending April 2nd 2024. This average price lags current benchmark Midwest weekly values by one week. The USDA Combined range for Large in the Midwest was $2.41 per dozen. At the high end of the range, the price in the South Central region attained $2.57 per dozen. The USDA Combined Price last week was approximately 20 cents per dozen above the 3-year average of $2.20 per dozen. This past week Midwest Large was approximately $0.70 per dozen below the corresponding week in 2023 that was falling from a peak price to $3.10 per dozen as production recovered from HPAI depletion and to declining market demand.

Flock Size

Previously the loss of approximately 13 million hens due to HPAI during the fourth quarter was not reflected in weekly USDA figures until the beginning of February. The loss of 3.5 million hens in early April is not reflected in current data. Increases in flock size during late February and early March amounted to fractions of a percent. The USDA has now published data to reflect previous losses due to HPAI depopulation and molted flocks reentering production during the post-Easter period but has yet to update figures for depletion in April.

Given the importance of weekly flock numbers to pricing, accurate values for producing and total flock are required by producers.

According to the USDA the number of producing hens reflecting April 3rd 2024 (rounded to 0.1 million) was apparently down 0.2 million to 306.4 million. The total U.S. flock includes about one million molted hens due to return to production Approximately 5.0 million pullets on average reach maturity each week, based on USDA monthly chick-hatch data for 20-weeks previously. The increase is offset by routine flock depletion and an additional loss of approximately 13 million hens during the last quarter of 2023. To date some flocks have been replaced but 3.5 million hens were depleted since the beginning of April. Based on inventory level and prices, the population of hens producing table eggs and breaking stock should now be producing at or below post-Easter demand by consumers. Industrial and food service off-take is increasing, approaching pre-COVID levels. Prices will continue to fluctuate but have shown atypical seasonal stability instead of a decline.

|

Egg Month

|

|

REVIEW OF MARCH 2024 EGG PRODUCTION COSTS AND STATISTICS.

Commencing in 2024 the EIC justifiably separated the production costs and unit revenue values for eggs derived from caged and cage-free flocks. Accordingly, EGG-NEWS will continue to summarize data but will consolidate production and export statistics for the U.S. egg industry as a total and compare financial data for the two shell-egg categories.

FEBRUARY HIGHLIGHTS

- March 2024 USDA ex-farm blended USDA nest-run, benchmark price for conventional eggs from caged hens was 187 cents per dozen, down 64 cents per dozen or 25.5 percent from the February 2024 value of 251 cents per dozen. For comparison, average monthly USDA benchmark price over 2023 was 146.0 cents per dozen with a range of 323 cents per dozen in January down to a low of 57 cents in May. Stock levels and prices prior to the onset of flock depletions due to HPAI indicated a relative seasonal balance between supply and demand. Future nest-run and wholesale prices will be largely dependent on consumer demand for shell eggs and products and the rate of replacement of pullets and hens depleted due to HPAI. Other considerations include diversion to shell sales from the egg-breaking sector in an interconnected industry.

- Fluctuation in wholesale price is attributed in part to the amplification of upward and downward swings associated with the commercial benchmark price discovery system in use. Restoration of seasonal prices commenced midway through the fourth quarter of 2023 with a plateau after Christmas followed by a seasonal decline through January 2024. A substantial rise in price occurred during February but with a sharp decline thereafter to mid-March. An unknown factor in future pricing will be the incidence rate and severity of highly pathogenic avian influenza in spring months with northward migration of waterfowl. Close to 13 million hens and 2.5 million pullets were depopulated during the fourth quarter of 2023 among five states with heavy losses in California. Approximately 3.5 million hens were depleted in two outbreaks (TX and MI) during early April.

- March 2024 USDA average nest-run production cost for generic eggs from caged flocks over four regions (excluding SW and West), applying updated inputs was down 0.7 cents per dozen to 75.3 cents per dozen compared to the February 2024 value of 76.0 cents per dozen, mainly attributable to a 1.7 percent lower average feed cost per dozen. Approximately 60 cents per dozen should be added to the USDA benchmark nest-run cost to cover processing, packing material and transport to establish a realistic price as delivered to warehouses.

- March 2024 USDA benchmark nest-run margin attained a positive value of 155.1 cents per dozen for generic eggs from caged flocks compared to a positive margin of 170.1 cents per dozen for January 2024. Average nest-run monthly margin over 2023 was 64.2 cents per dozen compared to 155 cents per dozen in 2022. This differential was mainly due to higher prices following HPAI-depletion of flocks. It is emphasized that the U.S. benchmark price reflects nest-run conventional eggs.

- The March 2024 national flock in production (over 30,000 hens per farm) was stated by the USDA to be down 0.1 million hens (rounded) to 294.6 compared to the revised February 2024 value of 294.7 million. This figure apparently takes into account depletion of 4.2million hens during December 2023 that were not recorded in the month. Approximately 3.0 million hens returned to production from molt in March together with projected maturation of 23.1 million pullets, with this number offset by depletion of spent flocks. During the fourth quarter of 2023 approximately 13 million hens and 2.5 million pullets were depopulated due to HPAI in five states.

- February 2024 pullet chick hatch of 27.9 million was up 6.9 percent or 1.8 million chicks from January 2024.

- February 2024 exports of shell eggs and products combined was up 62.5 percent from January 2024 to 641,300 case equivalents representing the theoretical production of 8.5 million hens. The increase was attributed to greater demand for shell eggs by Canada and egg products by Japan and the E.U. among other importing countries.

TABLES SHOWING KEY PARAMETERS FOR MARCH 2024.

Summary tables for the latest USDA March 2024 flock statistics, costs and unit prices made available by the EIC on April 8th 2024 are arranged, summarized, tabulated and compared with values from the previous March 13th 2024 posting reflecting February 2024 costs and production data as applicable. Monthly comparisons of production data and costs are based on revised USDA values.

VOLUMES OF PRODUCTION REFLECTING THE ENTIRE INDUSTRY

|

PARAMETER

|

MARCH 2024

|

FEBRUARY 2024

|

|

Table-strain eggs in incubators

|

56.6 million (Mar.)

|

59.1 million (Feb.)

|

|

Pullet chicks hatched

|

27.9 million (Feb.)

|

26.6* million (Jan.)

|

|

Pullets to be housed 5 months after hatch

|

26.9 million (July)

|

23.2* million (June)

|

|

EIC 2023 December 1st U.S. total flock projection

|

328.9 (Mar.)

|

328.0 million (Feb.)

|

|

National Flock in farms over 30,000

|

294.6million (Feb.)

|

294.7* million (Jan.)

|

|

National egg-producing flock

|

310.4 million (Feb.)

|

310.5* million (Jan.)

|

|

Cage-free flock excluding organic

|

106.5 million (Mar.)

|

106.5 million (Feb.)

|

|

Proportion of flocks in molt or post-molt

|

11.2% (Mar.)

|

11.2% (Feb.)

|

|

Total of hens in National flock, 1st cycle (estimate)

|

275.6 million (Feb.)

|

275.6 million (Jan.)

|

|

Total U.S. Eggs produced (billion)

|

7.40* February 2024

|

7.96* January 2024

|

|

Total Cage-Free hens in production

|

124.8 million (Mar.)

14.7% Organic

|

124.8 million (Feb.)

14.7% Organic

|

|

“Top-5” States hen population (USDA)1

|

145.0 million (Feb.)

|

148.5 million (Jan.)

|

* Revised USDA/EIC

Notes 1. Texas excluded to maintain confidentiality

|

Commodity Report

|

|

WEEKLY ECONOMY, ENERGY AND COMMODITY REPORT: April 11th 2024.

OVERVIEW

Prices for corn, soybeans and soybean meal were approximately one percent lower compared to last week. Prices were influenced by technical selling arising from geopolitical concerns and revised projections for crop sizes in Brazil and Argentine. Secondary factors included disruption in shipping in the Red Sea and Panama Canal, carryover from the 2023 U.S. crop, export orders and predicted ending stocks of corn and soybeans for the 2024 crop. There was no apparent response to release of the April WASDE that retained projections for production and ending stocks from the March report although prior to release of planting intentions. Prices for corn, soybeans and soybean meal were approximately one percent lower compared to last week. Prices were influenced by technical selling arising from geopolitical concerns and revised projections for crop sizes in Brazil and Argentine. Secondary factors included disruption in shipping in the Red Sea and Panama Canal, carryover from the 2023 U.S. crop, export orders and predicted ending stocks of corn and soybeans for the 2024 crop. There was no apparent response to release of the April WASDE that retained projections for production and ending stocks from the March report although prior to release of planting intentions.

At 12H00 on April 11th the CME price for corn was down 0.7 percent compared to the previous week to 431 cents per bushel for May delivery. Corn price was influenced by higher ethanol demand and the proportionally high ending stock of corn from the 2023 crop. Export orders for the current market year have increased in response to lower prices. Volumes and prices are indirectly influenced by higher wheat prices, events in the Black and Red Seas. Orders by China resumed at the end of the 2022-2023 market-year and have extended through March despite a slightly higher Dollar Index offset by a low FOB prices although with increased ocean freight. Total exports for the current market year are 34.2 percent higher than for the corresponding week during the 2022-2023 year.

Soybeans traded at 1,162 cents per bushel for May 2024 delivery down 1.0 percent over the week. Lower prices were attributed to short covering, farm selling and availability from the 2024 Brazil and Argentine harvests. Total exports for the current market year are 18.3 percent lower than for the corresponding week in the 2022-2023 year.

Soybean meal traded at $334 per ton for May delivery, down 0.6 percent compared to $332 per ton for last week. Price was influenced by demand coupled with high crush volumes for consecutive months from December 2023 onwards but with lower volume in January due to the impact of cold weather. Price will fluctuate to reflect the CME price for soybeans and the demand for biodiesel despite the adverse financial situation in this sector. The market previously responded to the increased 2023 crop and higher stocks together with projections for 2024 unchanged from March in the April WASDE Report.

WTI was 0.5 percent higher from last week to $85.92 at 13H00 GMT on April 10th with moderate world demand in relation to supply. Price is higher partly due to disruption in shipping in the Red Sea, and turbulence in the Middle East but is countered by U.S. production attaining 13.3 million barrels per day in March with ample reserves. An upward trajectory in price may occur if production cuts by OPEC amounting to 2 million barrels per day and extended through June actually materialize. There was stability in price during the week ($85.15 to $86.43 range). Crude oil inventory in the U.S., other than the Strategic Reserve, was down 0.5 percent to 33.0 million barrels last week. High U.S. production is constraining domestic and international prices but the rise in energy cost during past weeks is reflected in ‘sticky’ inflation restraining the FOMC from lowering the benchmark interest rate.

Factors influencing commodity prices in either direction over the past four weeks included:-

- Weather conditions in areas of the World growing corn and oilseeds especially in Brazil and also Argentine with favorable rain recently under the influence of a strong La Nina The 2023 U.S. harvest was completed ahead of the corresponding weeks in 2022 with higher carryover (Downward pressure on prices). Planting has commenced for the “new” crop of 2024.

- Geopolitical considerations continue to move markets, especially in the Mideast. Ongoing attacks on Ukraine port facilities have impacted prices of wheat, corn, oilseeds and vegetable oils. Loaded bulk vessels are sailing from Black Sea and Danube River ports using the ‘Humanitarian Corridor” to various destinations. This route is operational despite threats by the Russian Federation to mine the entrance to ports and deployment of airborne missiles. Exports from Ukraine are approaching 1.5 million metric tons per week with a total of 26 million metric tons market year through February, down 11 percent from the equivalent period for 2022-2023 year. Grain production in Ukraine during the current year will be lower than 2022/2023 (Downward pressure on corn and wheat and an indirect effect on soybeans)

- Macroeconomic U.S. factors:-

- Most economists in academia and the private sector are confident of a “soft landing” for the economy following the release of revised Q4 2023 GDP and recent releases of economic parameters including the CPI and anticipated PPI and a decline in bond rates. Annual inflation as measured by CPI declined from 8.9 percent in June 2022 to 3.5 percent in March 2024. This is in part a response to a series of 11 FOMC rate raises that curbed inflation and cooled the labor market but without precipitating unemployment. There is evident stability in the bank sectors in both the U.S. and Europe. Large U.S. banks passed stringent mid-year “stress tests”. There is now concern over regional banks with exposure to commercial real estate. A rise in energy prices is contributing to persistence of inflation.

- The Federal Reserve held the benchmark interest rate steady at the monthly FOMC meeting on March 20th 2024, the fifth sequential pause. The Federal Reserve commentary indicated that the rate would be held at 5.25 percent until a pivot with possibly less than two reductions of 25 basis points each in 2024, after the September meeting at the earliest. Chairman Powell in Congressional testimony and documented in FOMC minutes has indicated that decisions would be based on data and demonstrable progress in reducing inflation towards an annual 2.0 percent target by mid-2025. Market optimism with projections of five reductions during 2024 was evidently premature.

- The March 28th Bureau of Economic Affairs announcement of the advanced estimate of Q4 GDP confirmed a value of 3.4 percent, slightly above the previous estimate of 3.2 percent. The rise was attributed to increased consumer and government sector spending and investment in inventory. Growth in GDP attained 2.5 percent in 2023 up from 1.9 percent in 2022.

- On March 29th the Bureau of Economic Analysis released the February Personal Consumption and Expenditure Price Index (excluding food and energy) that was up 0.3 percent from the previous month to 2.8 percent year-over-year. This was in line with estimates. Food prices increased 0.1 percent but energy was up 2.3 percent in March. The Headline PCE Index was up 2.5 percent year-over-year also corresponding to estimates. The price of goods increased 0.1 percent from February and was higher than services at 0.3 percent. Consumer spending was up 0.8 percent, above estimates and compared with 0.2 percent in January, impacted by weather. The headline PCE is closely followed by the Federal Reserve and confirms declining inflation.

- The April 10th Bureau of Labor Statistics release of the March 2024 CPI confirmed a 0.4 percent increase from February, and 0.1 percent above forecast. The annual increase of 3.5 percent was up from 3.2 percent in February and higher than the anticipated value. The increase in the core value (excluding food and energy) was 0.4 percent from February and 3.8 percent for the 12-month period, and estimates. Food at home was unchanged from the previous month. The category of meat, fish and poultry was up collectively by 0.9 percent with eggs up 4.6 percent from the previous month. Food away from home was up 0.3 percent from February. On an annual basis all food was up 2.2 percent with food at home up 1.2 percent and food away from home up 4.2 percent. Energy was up 1.1 percent together with natural gas (-3.2 percent) in March. The shelter category was up 0.4 percent for the month and 5.7 percent over the past year. The macro trend is inclining towards reduced inflation due to a fall in energy prices but this category has recently moved up, detracting from deflation. The CPI heavily influences FOMC rate decisions.

- The March Producer Price Index for Final Demand (PPI) released on April 11th was up by 0.2 percent from February compared to an expectation of 0.3 percent. The PPI was up 2.1 percent over the past 12-months. This is compared to a 6.4 percent increase in 2022. The core PPI value excluding volatile fuel and food, was up 0.2 percent for March and up 2.8 percent for the 12-month period. Food was up 0.8 percent compared to a 1.1 percent increase in February.

- A Federal Reserve release on March 15th confirmed that industrial production rose 0.1 percent in February. Production was adversely affected by inclement weather during January with plant closures. Capacity utilization was unchanged at 78.3 percent, 1.3 percent below the 1972-2020 average.

- The March 26th report on Durable Goods Ordered during February 2024 was higher by 1.4 percent to $278 Billion after two months of declines. Transportation and specifically aircraft orders were up 3.3 percent. Excluding the Transportation component, new orders increased by 0.5 percent in February compared to January impacted by inclement weather. Shipments of durable goods increased 1.2 percent following a fall of 0.8 percent in January 2024.

- The March14th release of retail sales data showed a monthly rise of 0.6 percent in February. This value is compared to the revised 0.4 percent rise in December 2023. Retail sales in January were affected by harsh winter storms and a change in the basis of calculation. The Federal Reserve FOMC closely monitors this index as a measure of the trend in inflation.

- The April 1st release by the Institute for Supply Management (ISM®) documented the Manufacturing Index for March at 50.3 up from 47.8 in February and above the consensus of 48.4. New orders increased to 51.6 (49.2, February) and Production attained 54.6 (48.4, February).

- The April 1st release of the S&P Global U.S. Manufacturing PMI fell to 51.9 in March from a revised 52.2 in February but above the March 2023 value of 46.3.

- The Conference Board Consumer Confidence Index released on March 26th for February/March, rose to 104.7 points. This reading was almost unchanged from a revised 104.8 for the preceding four-week period. The Present Situation Index was up to 157.0 in March from 147.6 in February. The Expectations Index fell to 73.8 in March from 76.3 in February with values below 80.0 suggesting a future recession

- The March 15th University of Michigan Index of Consumer Sentiment fell to 75.5 for March down from a revised 76.5 in February. The Index was up from 63.5 percent in April 2023. Both the Current Economic Index (79.4unchanged from February) and the Index of Consumer Expectations (74.6 down from 75.2 in February) denote a cautious increase in consumer sentiment influenced by lower interest rates and moderating inflation despite geopolitical concerns.

- Non-farm payrolls added 303,000 for March, as documented by the Bureau of Labor Statistics on April 5th. This was more than the anticipated 214,000, and compares to the revised February value of 270,000. The increase is attributed to workers in the health care and government sectors. The unemployment rate fell to 3.8 percent with 15 million unemployed. Real average weekly earnings for March showed a 0.3 percent increase over February. Average hours worked rose 0.1 percent to 34.4 per week in March. Labor participation increased fractionally from 62.5 percent in February to 62.7 percent in March. Wage rates increased 4.1 percent over 12-months, the lowest gain since June 2021. Wage rates are closely followed by the Federal Reserve FOMC.

- The Bureau of Labor Statistics Job Openings and Labor Survey report released on April 2nd estimated 8.8 million job openings at the end of February, down 100,000 (-0.1 percent) from January 2024 and consistent with estimates. The February job openings number was the lowest value in 34 months and compares with the March 2022 value of 12.2 million during COVID.

- The seasonally adjusted initial jobless claims figure of 211,000 released on April 11th was down from the revised seasonally adjusted 211,000 for the week ending April 6th but lower than the Reuter’s estimate of 215,000. The four-week moving average increased by 250 to 215,000 The Bureau of Labor Statistics estimated 1.82 million continuing claims for the week ending March 30th up 28,000 from the previous week. There is evidence from data over the past three months that the labor market is cooling despite sporadic weekly fluctuation in new claims.

- The April 5th Bureau of Labor Statistics report recorded a 0.7 percent increase in non-Farm Productivity for 2023. Output increased by 2.6 percent with a 1.9 percent increase in inputs of labor and capital. Hours Worked was up by 1.3 percent in 2023

- The ADP® reported on April 3rd that private payrolls increased by 184,000 in March, up 29,000 from the revised 155,000 in January and compared to the Bloomberg estimate of 150,000 jobs. The increase in employment was mostly in the construction, financial services and manufacturing sectors. Annual pay was up 5.1 percent year-over-year unchanged from February. The increase will not directly influence the probability of short-term future changes in interest rate since the ADP® is regarded by the FOMC as an unreliable statistic

FACTORS INFLUENCING COMMODITY PRICES

- The 2023 harvests of corn and soybeans were completed by late November 2023. The April 11th WASDE provided a projection for acreage to be planted, yields, crop size and ending stocks for the 2024 crop.

- It is evident that both polarization in the closely divided chambers of Congress and intra-party conflict between and among both sides of the aisle in the House delayed adoption of appropriations bills. Passage of the 2023 Farm Bill will be contentious and is subject to a 12-month extension as a stop-gap measure. Progress on the 2023 Farm Bill has been impeded by contention over SNAP eligibility and other entitlements that collectively represent 75 percent of total expenditure. The August 2nd downgrade of U.S. debt from AAA to AA+ by Fitch Ratings recognizes Congressional dysfunction. On November 10th 2023 Moody’s downgraded U.S. credibility from ‘stable’ to ‘negative’ based on an inability to pass required fiscal legislation. After four Continuing Resolutions the House and Senate passed six appropriations bills including the FDA and USDA, avoiding a March 8th partial shutdown of the Federal Government. Agreement was concluded on the remaining appropriations bills on March 23rd maintaining Federal funding through October 2024. Currently the Speaker of the House is experiencing difficulty in arranging for passage of legislation.

- The delayed 2023 Farm Bill is mired in conflict in both the House and Senate. There is no consensus on major issues comprising the magnitude of SNAP payments and eligibility and requested price supports for crops. The Chair of the Senate Agriculture Committee Sen. Debbie Stabenow (D-MI) is standing firm on maintaining both SNAP-WIC benefits and climate remediation funding even if the Farm Bill is delayed through to the 119th Congress

- The April 11th WASDE #647 Projected both corn and soybean production parameters with a potential record corn harvest for the 2024 crop. There will be ample world availability of ingredients although inequitable distribution will result in shortages in some nations. Soybean exports will comprise 38.2 percent of the 2024 U.S. crop with a 7.7 percent increase in ending stock to 340 million bushels as compared to the March WASDE Report.

- Rabobank projected the soybean crop in Brazil at 153 million metric tons on April 4th. This value is higher than the projection by CONAB (the Soy production association in Brazil) at the midpoint of the soybean harvest, of 147 million metric tons (5,401 million bushels) down from a previous estimate of 155 million metric tons (5,695 million bushels). Exports of 100 million metric tons (3,674 million bushels). It is anticipated that Brazil will crush 56 million metric tons (2,057 million bushels). If CONAB is correct the harvest will be 7 million metric tons (269 million bushels) lower than the 2023 record crop. Brazil exported 7.0 million metric tons (257 million bushels) of soybeans to China over the first two months of 2024, double the quantity shipped to this nation over the corresponding two months in 2023.

- Corn production in Brazil for the 2023-2024 market year will attain 124 million metric tons (4,801 million bushels) from all three sequential harvests. But down seven percent from the previous year. Brazil is projected to export of 54 million metric tons (2,125 million bushels). Argentine will produce 50 million metric tons of corn (1,968 million bushels), double compared to the previous year impacted by drought. (Lower prices in the future subject to favorable reports on crop progress and actual harvests)

- The Dollar Index (DXY) was 105.2 at noon on April 10th, up 1.0 point from last week responding to CPI data suggesting retention of current benchmark interest rates for a prolonged period. The DXY has ranged from 99.0 to 107.0 over the past 52 weeks. The dollar index influences timing and volume of export orders and indirectly the price of WTI crude.

EXPORTS

The FAS Export Report for corn, released on April 11th for the week ending April 4th confirmed that outstanding export orders for corn amounted to 15.60 million metric tons (614.02 million bushels). Net orders for the past week for the 2023-2024 market year amounted to 0.33 million metric tons (12.79 million bushels). Shipments recorded during the past working week amounted to 1.55 million metric tons (61.28 million bushels). For the current market year to date cumulative export of 28.88 million metric tons (1,125 million bushels) is 34.2 percent higher compared to the equivalent week of the previous market year. For market year 2024-2025 outstanding orders attained 1.76 million metric tons (69.55 million bushels) with 9,300 metric tons (373,920 bushels) ordered this past week

(Conversion 39.36 bushels per metric ton. Quantities in metric tons rounded to 0.1 million)

The FAS Export Report for soybeans covering the week ending April 4th reflecting market year 2023-2024, recorded outstanding export orders amounting to 3.59 million metric tons (11.22 million bushels). Net orders this past week attained 0.19 million metric tons (7.12 million bushels). Shipments for the past working week attained 0.50 million metric tons (18.48 million bushels). For the current market year to date cumulative exports of 37.26 million metric tons (1,369 million bushels) are 18.3 percent lower compared to the equivalent week of the previous market year. Outstanding orders for the 2024-2025 market year amount to 0.47 million metric tons metric tons (17.27 million bushels) with no orders tons this past week.

(Conversion 36.74 bushels per metric ton)

For the week ending April 4th 2023 outstanding orders for soybean meal and cake attained 3.07 million metric tons. Net orders this week for soybean meal and cake amounted to 187,900 metric tons. During the past week 280,500 metric tons of meal and cake combined was shipped. The quantity exported to date is 15.2 percent higher than the volume for the corresponding weeks of the previous market year. For the next market year outstanding sales have attained 308,100 metric tons with 53,400 tons ordered this past week.

|

USDA-WASDE REPORT #647, April 11th 2024

|

|

OVERVIEW

The USDA provided pre-planting values for the production of corn and soybeans in the April 11th World Agriculture Supply and Demand Estimates (WASDE) #647, reflecting the anticipated 2024 crop. Most values were understandably unchanged from the March edition given the month and are based on projections of acreage, yield, carry-forward levels from 2023, and with realistic assumptions of domestic use and exports giving rise to ending stocks.

The April 11th WASDE report predicted that corn would be harvested from 86.5 million acres, unchanged since February. The soybean crop will be harvested from 82.4 million acres also unchanged.

The most recent report retained the yield value for the 2024 corn crop at 177.3 bushels per acre. By comparison yield was 174.9 bushels per acre in 2023. The soybean yield was held at 50.6 bushels per acre compared to 49.9 bushels per acre in 2023.

The April 2024 USDA projection for the ending stocks of corn was 2,152 million bushels, down 2.3 percent from 2,172 million bushels in the March WASDE. The April 2024 USDA projection for the ending stock of soybeans was 340 million bushels, up 7.9 percent from 315 million bushels in March.

The April 2024 WASDE lowered the ex-farm price of corn by 5 cents to 470 cents per bushel. The projected average season price for soybeans was reduced 10 cents per bushel from the March WASDE of 1,255 cents per bushel. Soybean Meal was unchanged at $380 per ton.

Projections for world production included in the March 2024 WASDE report reflect the most recent estimates for commodities in the Southern Hemisphere with an emphasis on Argentine and Brazil. Economists also evaluated the likely impacts from hostilities in Ukraine with occupation of ten percent of the Nation’s land area by the Russian Federation and following extensive destruction of agricultural infrastructure. It is evident that production and hence exports of wheat, corn and sunflower from Ukraine will be reduced compared to pre-war averages. Exports from Ukraine have been restored following the collapse of the Black Sea Grain Initiative and destruction of Black Sea and Danube Delta port installations. These adversities have been partly overcome by aggressive naval action allowing the “Humanitarian Corridor” that traverses the national waters of friendly countries along the western Black Sea coast.

It is accepted that USDA projections for export are also based on the perceived intentions and needs of China. This Nation has sharply curtailed purchases of commodities and especially U.S. soybeans during the current market year despite drought and taking into effect relaxation of COVID restrictions on consumers with higher demand.

Reports on volumes of commodities exported are included in weekly editions of EGG-NEWS, derived from published USDA-FAS sales data.

|

Diagnostic Centers Investigating Bovine Influenza-H5N1

|

|

Dr. Diego Diel, Director of the Virology Laboratory at the Animal Health Diagnostic Center at the Cornell University College of Veterinary Medicine, will undertake molecular and epidemiologic studies on emerging Bovine Influenza-H5N1. He noted, “We will study how HPAI spilled over into dairy cows to understand why these outbreaks happened.” He added, “There are a number of very important questions about its source and the risk of transmission to other animals and humans that need to be addressed. It is noted that diagnosticians at the Cornell Diagnostic Center identified H5N1 influenza virus in specimens submitted from an affected herd in Texas. The Center was prompted to examine for avian influenza virus following reports that dead grackles and sick cats accompanied the outbreak of the then undiagnosed condition in dairy cows characterized by an acute decline in milk yield, anorexia and mild respiratory signs. Dr. Diego Diel, Director of the Virology Laboratory at the Animal Health Diagnostic Center at the Cornell University College of Veterinary Medicine, will undertake molecular and epidemiologic studies on emerging Bovine Influenza-H5N1. He noted, “We will study how HPAI spilled over into dairy cows to understand why these outbreaks happened.” He added, “There are a number of very important questions about its source and the risk of transmission to other animals and humans that need to be addressed. It is noted that diagnosticians at the Cornell Diagnostic Center identified H5N1 influenza virus in specimens submitted from an affected herd in Texas. The Center was prompted to examine for avian influenza virus following reports that dead grackles and sick cats accompanied the outbreak of the then undiagnosed condition in dairy cows characterized by an acute decline in milk yield, anorexia and mild respiratory signs.

Dr. Louise Moncia of the University of Pennsylvania School of Veterinary Medicine noted that sequencing of the genome of the diary cow isolates confirmed sequences corresponding to isolates from wild birds in the vicinity of the index farm. The gene sequences of the isolates from a Minnesota goat herd diagnosed in late March were similar to an isolate from pheasants in Colorado.

Based on the single case of human infection resulting in conjunctivitis, the Centers for Disease Control and Prevention are actively investigating characteristics of the virus with specific interest in possible changes in genes among avian and ruminant H5N1viruses with respect to the human isolate. According to a CDC release, a change in PB2 E67K was present and associated with adaptation of the avian precursor to mammalian hosts. Even though changes have occurred in this genetic marker, there is no evidence of the potential to infect humans and with a high probability that human-to-human transmission will not occur.

Epidemiologists have noted that the single patient who worked on the affected dairy farm showed only mild conjunctivitis. This could mean that in the future infections might not be recognized and will not be diagnosed providing an opportunity for the virus to adapt to humans. The University of Minnesota is urging dairy farmers to apply common sense precautions to prevent exposure including the use of protective personal equipment for workers in contact with milking cows, raw milk and calves. The University Moos Room Podcast urged farmers to report illness among themselves and their workers, especially those not conversant in English to detect any possible cases of transmission from herds.

On a more optimistic note, scientists at the CDC noted correspondence between the hemagglutinin gene from the virus isolated from the patient with two candidate vaccine viruses that could be used to produce a specific vaccine. The neuraminidase gene of the isolate from the human case was devoid of resistance markers that will allow antiviral drugs including oseltamivir to be administered as an effective therapeutic agent.

|

Criticism of Egg Decoration Contest Unjustified

|

|

In the current politically charged media environment, criticism was leveled against the Administration for apparently banning “religious themes” from the annual children’s egg-decorating contest. This year children of National Guard members participated in submitting designs for commemorative eggs.

It is an established tradition and policy that designs “should not include any questionable content, overtly religious themes or partisan political statements.” This policy has been in place for many years antedating the current Administration. Criticism was countered by the American Egg Board (AEB) that sponsors the White House Egg Roll noting that the “Guidance language referenced in recent news reports has been consistently applied by the Board since the founding of the competition extending across many Administrations.” The AEB response included “The White House Easter Egg Roll is a nonpartisan activity and is intended to provide enjoyment for children and families. Let’s not introduce a partisan slant to an event that has extended from the Administration of President Rutherford B. Hayes”.

|

|

|

Northland Boom Introduces E-Drive Vaccinator

|

|

Northland Boom Custom Spray has designed the E-Drive aerosol vaccinator to administer vaccines by the spray route in both cage and aviary systems. The new model is self-propelled reducing the time required to immunize flocks and was developed in collaboration with egg producers. Northland Boom Custom Spray has designed the E-Drive aerosol vaccinator to administer vaccines by the spray route in both cage and aviary systems. The new model is self-propelled reducing the time required to immunize flocks and was developed in collaboration with egg producers.

Based on practical experience and application, the E-Drive Vaccinator incorporates a shield to deflect birds from the front of the unit as it transits between modules. Based on practical experience and application, the E-Drive Vaccinator incorporates a shield to deflect birds from the front of the unit as it transits between modules.

The E-Drive Vaccinator incorporates a single boom that can be customized according to the number of tiers and their height. The unit incorporates two batteries. One powers the drive motor and the other energizes the compressor and other functions.

The unit is capable of distributing droplet sizes from 20-200 microns depending on the selection of nozzles. Fine to coarse adjustment of the unit is possible during operation. The delivery rate ranges from 4 to 28 gallons per hour depending on nozzle delivery

Each unit is customized for intended operation and is covered by a warranty.

A demonstration model will be on display at the Northland Boom Booth # 735 at the PEAK Exhibition

|

USDA Fertilizer Production Program Expanded

|

|

The USDA has assigned more than $174 million to 42 projects nationwide to increase production of fertilizer. Projects include installations to dry and decontaminate animal waste that can be used as a fertilizer. Grants included improvements in infrastructure and business development in rural areas including tribal and low-income areas. The USDA has assigned more than $174 million to 42 projects nationwide to increase production of fertilizer. Projects include installations to dry and decontaminate animal waste that can be used as a fertilizer. Grants included improvements in infrastructure and business development in rural areas including tribal and low-income areas.

The Fertilizer Production Expansion Program could subsidize manure-drying installations for egg production units. Some complexes of over 500,000 hen capacity have installed rotary dryers to convert waste from either high-rise houses or belt collection systems to a valuable organic fertilizer for agricultural, commercial and domestic uses. Subscribers are directed to Uzelac Industries for technical information and financial projections. The Uzelac website can be accessed by clicking onto the company logo on the right side of the Welcome page. The Fertilizer Production Expansion Program could subsidize manure-drying installations for egg production units. Some complexes of over 500,000 hen capacity have installed rotary dryers to convert waste from either high-rise houses or belt collection systems to a valuable organic fertilizer for agricultural, commercial and domestic uses. Subscribers are directed to Uzelac Industries for technical information and financial projections. The Uzelac website can be accessed by clicking onto the company logo on the right side of the Welcome page.

|

Hamlet Protein Sponsors American Society of Animal Science Program

|

|

Hamlet Protein was a corporate sponsor of the Midwest Section Meeting of the American Society of Animal Science (ASAS). The event held from March 10th through 13th included a presentation by Dr. Megan Bible on protein kinetics.

Grady Fain, Regional Director for North and Central America for Hamlet Protein noted, “we are proud to be sponsoring the annual meeting of ASAS. The event offers a wonderful opportunity to engage with opinion leaders, industry friends and customers and keep abreast of the most recent scientific developments in our market”.

Dr. Megan Bible, a presenter observed “Knowing the protein kinetics of an ingredient allows nutritionist to formulate diets with a higher protein biological value optimizing performance and therefore lower feed cost”. Dr. Megan Bible, a presenter observed “Knowing the protein kinetics of an ingredient allows nutritionist to formulate diets with a higher protein biological value optimizing performance and therefore lower feed cost”.

Hamlet Protein manufactures a soybean-based protein ingredient for poults, chicks, and piglets with plants in Denmark and the U.S. distributed worldwide.

|

NOAA Predicts Low Mississippi River Water Level with Obvious Cost Implications

|

|

The National Oceanic and Atmospheric Administration (NOAA) predicts a third consecutive year of hot and dry weather in the Mississippi River Basin. For the past two years, low water level has impeded barge shipment along the Mississippi River system. For a few weeks during 2022, 100 towboats and 2,000 barges were idled as a result of low water level. This was followed by a similar period of reduced traffic during late August through September 2023. Less volume transported as a result of limiting passage raises freight rates. This directly places competitors of the U.S. including Brazil and Argentine at an advantage, impacting the volume of U.S. exports. Increased freight rates are reflected in higher feed costs for broiler and egg producers in the Southeast since there is reliance on barge transport for major ingredients. Alternatives including road and rail freight are unable to compensate for delays and restrictions on the Mississippi waterway. The National Oceanic and Atmospheric Administration (NOAA) predicts a third consecutive year of hot and dry weather in the Mississippi River Basin. For the past two years, low water level has impeded barge shipment along the Mississippi River system. For a few weeks during 2022, 100 towboats and 2,000 barges were idled as a result of low water level. This was followed by a similar period of reduced traffic during late August through September 2023. Less volume transported as a result of limiting passage raises freight rates. This directly places competitors of the U.S. including Brazil and Argentine at an advantage, impacting the volume of U.S. exports. Increased freight rates are reflected in higher feed costs for broiler and egg producers in the Southeast since there is reliance on barge transport for major ingredients. Alternatives including road and rail freight are unable to compensate for delays and restrictions on the Mississippi waterway.

Under the bipartisan infrastructure law, funding has been allocated to improved bulk terminal grain storage and handling. Dredging channels and upgrading of locks is in progress after neglect for decades. Notwithstanding improvements, the entire transport system is reliant on an adequate water level that is in turn determined by rainfall and melting of snowpack in the Mississippi catchment area.

|

Amazon to Phase Out Autonomous Check Out

|

|

The extensively promoted “Just Walk Out” installations in Amazon Fresh and Amazon Go locations will be removed. As with self-checkout, consumer resistance resulted in the change in policy. An Amazon spokesperson stated, “We have invested a lot of time redesigning a number of our Amazon Fresh stores over the last year, offering a better, overall shopping experience with more value and convenience.” The statement continued, “We have also heard from customers that while they enjoyed the benefit of skipping the checkout line with “Just Walk Out”, they wanted the ability to easily find products and deals and view their receipt as they shop.” The extensively promoted “Just Walk Out” installations in Amazon Fresh and Amazon Go locations will be removed. As with self-checkout, consumer resistance resulted in the change in policy. An Amazon spokesperson stated, “We have invested a lot of time redesigning a number of our Amazon Fresh stores over the last year, offering a better, overall shopping experience with more value and convenience.” The statement continued, “We have also heard from customers that while they enjoyed the benefit of skipping the checkout line with “Just Walk Out”, they wanted the ability to easily find products and deals and view their receipt as they shop.”

Amazon will continue to sell the technology to third party users and will retain the systems in Amazon Go stores in the U.K. Amazon.

Dash carts with electronic features that allow customers to monitor purchases and to skip the checkout line will be retained.

|

Retirement of Jeff Hardin

|

|

Jeff Hardin, Senior Vice-President of Sales for Cal-Maine Foods will retire after a long career with the company. He will be succeeded by Scott Hull, Vice-President of Sales, with immediate effect. Jeff will continue to assist Scott through a transition period. Scott Hull joined Cal-Maine Foods in 2009 and served as General Manager of the Louisburg, NC. complex before joining the sales team as National Sales Manager in 2014. Jeff Hardin, Senior Vice-President of Sales for Cal-Maine Foods will retire after a long career with the company. He will be succeeded by Scott Hull, Vice-President of Sales, with immediate effect. Jeff will continue to assist Scott through a transition period. Scott Hull joined Cal-Maine Foods in 2009 and served as General Manager of the Louisburg, NC. complex before joining the sales team as National Sales Manager in 2014.

Sherman Miller, President and CEO stated, “Jeff Hardin has been an outstanding sales leader for Cal-Maine Foods, and we are extremely grateful for his 36 years of dedicated service. He has developed strong working relationships with our valued  customers and provided exceptional service and support that are hallmarks of Cal-Maine Foods. Scott Hull assumes additional sales leadership responsibilities and has demonstrated his ability to lead our sales efforts.” customers and provided exceptional service and support that are hallmarks of Cal-Maine Foods. Scott Hull assumes additional sales leadership responsibilities and has demonstrated his ability to lead our sales efforts.”

EGG-NEWS joins the U.S. egg-production community in wishing Jeff a happy and contented retirement that is well earned.

|

USDA-Foreign Agricultural Service Announces Funding Opportunities for Exports

|

|

USDA-Foreign Agricultural Service (FAS) administers four market promotion programs relevant to poultry. Applications are now due for FY 2025 with an application deadline of June 14, 2024. USDA-Foreign Agricultural Service (FAS) administers four market promotion programs relevant to poultry. Applications are now due for FY 2025 with an application deadline of June 14, 2024.

The programs include: -

- Market Access Program – This is a competitive cost-share program for exporters to promote international sales

- The Foreign Market Development Program assists trade associations to build long-term international demand.

- The Quality Samples Program allows trade organizations to provide samples of products to prospective importers.

- The Emerging Markets program supports technical assistance activities to develop emerging markets for livestock and agricultural products.

Details are available on <www.FAS.USDA.Gov/Programs>

|

USDA Assigns $120 Million for Rural Energy Programs

|

|

In a March 28th announcement, the U.S. Department of Agriculture announced an infusion of $120 million into the Rural Energy for American Program (REAP) to fund 541 projects. Improvement in infrastructure through the REAP included: In a March 28th announcement, the U.S. Department of Agriculture announced an infusion of $120 million into the Rural Energy for American Program (REAP) to fund 541 projects. Improvement in infrastructure through the REAP included:

- Installation of wind turbines at a grain storage facility in Nebraska generating 138,000 kilowatt hours per year.

- A biomass furnace to be installed by an Idaho facility to replace obsolete equipment

- A Maine farm will be able to install a roof-mounted solar system generating 50,000 kWh annually.

USDA has assigned $1.8 billion to the REAP program for more than 6,000 renewable energy projects to lower costs, generate income and improve resiliency.

As with many USDA projects under the current Administration it is questioned whether there will be adequate control over expenditure and eventual confirmation that benefits accrue to the recipients and community. A total of 6,000 projects over three years is a prodigious  quantity to control with the potential for misappropriation, wastage and failure to attain desired benefits. Will the USDA ever provide an accounting to taxpayers? Will the quantum of expenditure receive appropriate scrutiny by the GAO? quantity to control with the potential for misappropriation, wastage and failure to attain desired benefits. Will the USDA ever provide an accounting to taxpayers? Will the quantum of expenditure receive appropriate scrutiny by the GAO?

|

2024 National Trade Estimate Report on Foreign Trade Barriers

|

|

Each year the Trade Representative of the U.S. is required to submit a report to Congress on barriers to trade and investment that disadvantage domestic companies. The 2024 report under signature of, Ambassador Katherine Tai, U.S. Trade Representative (USTR), identified significant barriers to exports of U.S. agricultural products. These included opaque and burdensome facility registration requirements, nonscientific barriers based on sanitary measures, failure to recognize approval of established biotechnology with reference to the E.U. and Mexico. Unjust restrictions as a result of local or regional outbreaks of highly pathogenic avian influenza (HPAI) have impeded exports to many nations including the People’s Republic of China that in any event has endemic HPAI of diverse strains. Each year the Trade Representative of the U.S. is required to submit a report to Congress on barriers to trade and investment that disadvantage domestic companies. The 2024 report under signature of, Ambassador Katherine Tai, U.S. Trade Representative (USTR), identified significant barriers to exports of U.S. agricultural products. These included opaque and burdensome facility registration requirements, nonscientific barriers based on sanitary measures, failure to recognize approval of established biotechnology with reference to the E.U. and Mexico. Unjust restrictions as a result of local or regional outbreaks of highly pathogenic avian influenza (HPAI) have impeded exports to many nations including the People’s Republic of China that in any event has endemic HPAI of diverse strains.

Ambassador Tai noted “The USTR is determined to use all available tools to ensure that U.S. agricultural producers are provided fair access to compete on a level playing field globally.”

The report highlighted the lack of uniformity among nations in the European Union. Different policies are imposed across member states including labeling, agriculture biotechnology, packaging and intellectual property. The competitiveness of U.S. industries is threatened by subsidies, financial support and other preferences and policies to the advantage of foreign goods. The report highlighted the lack of uniformity among nations in the European Union. Different policies are imposed across member states including labeling, agriculture biotechnology, packaging and intellectual property. The competitiveness of U.S. industries is threatened by subsidies, financial support and other preferences and policies to the advantage of foreign goods.

The office of the USTR constantly evaluates situations to determine whether barriers are based on legitimate scientific and public concerns or are unjustified barriers to free trade. In the event of unjust obstruction to U.S. imports, the USTR initiates action through the World Trade Organization and for specific barriers including dairy exports to Canada and GM corn to Mexico, through the appeals processes allowed under the USMCA Trade Pact.

|

A Workaround for Key Bridge Collapse

|

|

Coast guard Captain David O’Connell, Commander of the Maryland-National Capital Region announced the opening of a temporary channel under the collapsed Francis Scott Key bridge. With a draught of 12 foot, a 264 foot horizontal opening and a 96 foot vertical clearance the temporary channel would allow passage of relatively small, commercially essential vessels. Coast guard Captain David O’Connell, Commander of the Maryland-National Capital Region announced the opening of a temporary channel under the collapsed Francis Scott Key bridge. With a draught of 12 foot, a 264 foot horizontal opening and a 96 foot vertical clearance the temporary channel would allow passage of relatively small, commercially essential vessels.

Removal of wreckage in the Patapsco River is in progress but will take weeks before there is free passage to the Port of Baltimore. Using floating cranes and barges responders are removing containers from the mv Dali in preparation from freeing the vessel from the tangled wreckage of the bridge.

|

ADM Animal Nutrition Recalls Wide Range of Feeds

|

|

According to an April 3, 2024, FDA release, ADM Animal Nutrition has recalled diets for chicken, hogs, cattle, and horses. Problems involved excessive quantities of magnesium, sodium chloride or calcium in diets, potentially resulting in deleterious outcomes. ADM responded to customer complaints, confirming incorrect specifications resulting in recalls. According to an April 3, 2024, FDA release, ADM Animal Nutrition has recalled diets for chicken, hogs, cattle, and horses. Problems involved excessive quantities of magnesium, sodium chloride or calcium in diets, potentially resulting in deleterious outcomes. ADM responded to customer complaints, confirming incorrect specifications resulting in recalls.

Diets were produced in the Quincy, IL plant and were marketed in numerous states through distributors.

The wide range of diets implicated and the apparent inclusion of high levels of diverse ingredients suggests deficiencies in plant operation including mixing and in quality control.

The FDA released specified trade names for the affected bagged feeds.

|

Updated National Organic Program Handbook

|

|

The USDA has released an updated version of the National Organic Program Handbook. This document includes a list of accredited certifiers, guidance, and policy documents. The USDA has released an updated version of the National Organic Program Handbook. This document includes a list of accredited certifiers, guidance, and policy documents.

The 2024 Program Handbook includes a list of updated and archived documents, citations for the information of organic producers.

|

World Escalation in Food Prices

|

|

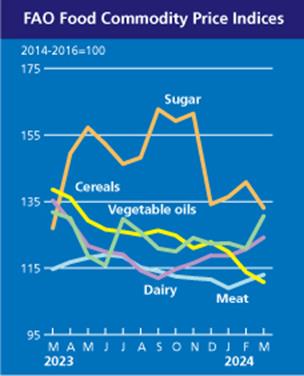

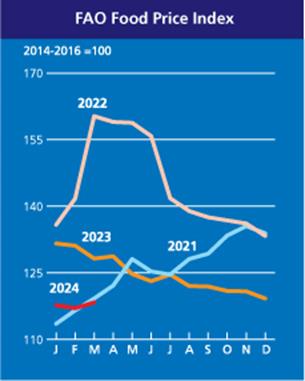

On April 5th the United Nations Food and Agricultural Organization released the Index of Food Commodities for March 2024. A sequential 12-month reduction in food prices is evidenced by the 7.7 percent decrease in the Index from 131.1 in February 2023 to the most recent value of 118.3 but the Index was up 1.1 percent from the previous month.

Component indices included:-

- The Meat index in March was up 1.7 percent from February to 113.0 points with higher poultry, pork and beef prices due to Easter demand but with lower prices for ovine products due to increased supply from Australia.

- The Cereal Index was down 2.6 percent from February to 110.8 points due to lower rice, wheat and barley prices but offset by an increase in corn.

- The Vegetable Oil Index was up a noteworthy 8.0 percent from February to 130.6 points with higher prices for palm, soy and sunflower oils on increased demand and diversion to biodiesel in the U.S. and Brazil.

- The Dairy Index was up 2.9 percent from February to 113.0 points

Boutiful crops in Brazil and Argentina with restoration of Black Sea shipping using the ‘Humanitarian Corridor’ have collectively reduced concern over availability of grains and oilseeds and contributed to a moderation in prices for grain and oilseed commodities.

|

|

|

Cargill Progress in Transitioning to Renewable Energy

|

|

Cargill has a commitment to reduce greenhouse gas emissions by 10 percent before 2025. To date, based on a 2017 baseline, the Company has achieved a reduction of 11 percent. Cargill is contracting with suppliers of renewable energy through 15 projects using purchase agreements and virtual power purchase agreements. Cargill has a commitment to reduce greenhouse gas emissions by 10 percent before 2025. To date, based on a 2017 baseline, the Company has achieved a reduction of 11 percent. Cargill is contracting with suppliers of renewable energy through 15 projects using purchase agreements and virtual power purchase agreements.  The program extends across twelve countries where Cargill has a presence. The program extends across twelve countries where Cargill has a presence.

Recently, five new transactions were concluded adding 300 megawatts of either wind or solar capacity to extend the renewable energy portfolio to 716 megawatts.

|

U.S. Fish and Wildlife Service Plan to Eradicate Barred Owls

|

|

The Barred Owl, a native species to the U.S., is encroaching on the habitat of the Spotted Owl in the Pacific Northwest endangering the native species. The U.S. Fish and Wildlife Service intend to kill up to 500,000 Barred Owls by 2055 in an attempt to restore the balance between the species. The Barred Owl, a native species to the U.S., is encroaching on the habitat of the Spotted Owl in the Pacific Northwest endangering the native species. The U.S. Fish and Wildlife Service intend to kill up to 500,000 Barred Owls by 2055 in an attempt to restore the balance between the species.

Eighty-five organizations including the Audubon Society have expressed opposition to the proposal. Killing a vast quantity of Barred Owls that closely resemble the species they wish to preserve will inevitably result in misidentification in depopulation. The Agency is urged to either find an alternative solution to protect Spotted Owls or as the Los Angeles Times editorialized “Let nature take its course and leave it to the owls.” The editorial also questioned the ethics and justification of conserving one species by the killing of another.

|

Trade Mission to Korea A Success

|

|

The recent trade mission led by Alexis M. Taylor, USDA Undersecretary for Trade and Foreign Agricultural Affairs, should be considered a success. More than six hundred meetings with potential importers were arranged. U.S. companies reported $67 million in orders to be filled during the coming twelve months. The population of South Korea now at 50 million offers an opportunity for exports of U.S. agricultural products.

For the first two months of 2024, South Korea imported 635 metric tons of egg products valued at $2.5 million. Exports were up 177 percent in volume and 92 percent in value over the corresponding first two months of 2023. This is in part due to demand over the Lunar New Year and limited supply of shell eggs and products following depletion of flocks as a result of outbreaks of HPAI.

|

|

|

San Francisco Ordinance To Requiring Notice Before Closing a Grocery Store

|

|

In yet another example of California anti-business bias, the City of San Francisco intends to enact an ordinance requiring grocery stores to give six months’ notice before closing. In addition, it will be necessary to search for a replacement and to interact with the impacted community. The proposed ordinance was originally considered in 1984 but was vetoed by the then Mayor Dianne Feinstein exercising sound judgment. In yet another example of California anti-business bias, the City of San Francisco intends to enact an ordinance requiring grocery stores to give six months’ notice before closing. In addition, it will be necessary to search for a replacement and to interact with the impacted community. The proposed ordinance was originally considered in 1984 but was vetoed by the then Mayor Dianne Feinstein exercising sound judgment.

As in the case of Chicago, grocery chains that attempted to provide retail service to consumers in so-called ‘food deserts’ have been afflicted with theft and operate in dangerous environments. Criminal activity in these high-risk areas including downtown appear to be beyond the control of police and the judicial system.

The proposed ordinance is another case of California elected officials spending other people’s money and creating an unattractive business environment. Supervisor, Dean Preston, has led the charge to resurrect the 1984 ordinance, stating, “Food insecurity is on the rise especially for seniors and families as food prices skyrocket and food programs face major cuts.” Preston would generate greater benefits to his constituents by encouraging community support, eliminating crime and providing civic services to retailers to encourage them to maintain functional operations. The proposed ordinance is another case of California elected officials spending other people’s money and creating an unattractive business environment. Supervisor, Dean Preston, has led the charge to resurrect the 1984 ordinance, stating, “Food insecurity is on the rise especially for seniors and families as food prices skyrocket and food programs face major cuts.” Preston would generate greater benefits to his constituents by encouraging community support, eliminating crime and providing civic services to retailers to encourage them to maintain functional operations.

|

Walmart Settles Class-Action Lawsuit

|

|

Walmart, Inc. will pay $45 million to settle a class-action lawsuit. The Plaintiffs alleged incorrect charging of customers purchasing meat and produce by weight. The 2022 filing claimed that Walmart apparently overcharged for meat products that were advertised at rollback prices that were not offered at checkout. Walmart, Inc. will pay $45 million to settle a class-action lawsuit. The Plaintiffs alleged incorrect charging of customers purchasing meat and produce by weight. The 2022 filing claimed that Walmart apparently overcharged for meat products that were advertised at rollback prices that were not offered at checkout.

Walmart settled the case “to avoid the uncertain outcome of a jury trial and to limit costs of litigation”. The company denied misleading customers.

According to the settlement, consumers who consider that they may have been overcharged are requested to file claims to receive compensation. The one absolute in this case is that the lawyers representing the class will have first pick at the proceeds.

|

Georgia Opposes U.S. EPA Effluent Guidelines

|

|

The Attorney General of Georgia, Chris Carr, has joined 26 other Attorneys General to oppose the Effluent Limitations Guidelines proposed by the U.S. Environmental Protection Agency. The Attorney General of Georgia, Chris Carr, has joined 26 other Attorneys General to oppose the Effluent Limitations Guidelines proposed by the U.S. Environmental Protection Agency.

Opposition to the proposed guidelines is based on the high cost of compliance that would increase the price of meat, poultry and egg products to consumers. It is estimated that with the more stringent guidelines, EPA jurisdiction over 150 processing plants would be increased to 3,000 facilities.

The letter submitted by the AGs noted “Evident escalation in the intensity of regulations issued by federal agencies, harms the integrity of our judicial system and this Administration should stop abusing the legal system to achieve results it otherwise cannot get”. Legality of the Effluent Limitations Guidelines is questioned since the proposed rule would extend the statutory authority of the Environmental Protection Agency under the Clean Water Act.

|

Commentary

|

|

|